Enter the BIN code of any credit card number and validate it in seconds using our BIN checker. The BIN code consists of the first 6 to 8 digits of the credit card number.

More Tools

Our BIN Validator lets you quickly validate and verify the BIN code of any CC number. By using our tool, you can make sure that the BIN code belongs to a valid credit card number.

This BIN checker can be very useful for security purposes, as it allows you to check the authenticity of the CC numbers before processing a payment.

Oftentimes, as an online merchant, you only get to see the first few digits of the CC number submitted by a customer. If you have reason to suspect the number, you can take the first six digits (in some cases, it is eight) and enter them into the tool.

Let’s look at the steps you must follow to use our BIN lookup, as well as the results you will receive once the checking process is over.

Using our BIN validator is very easy and simple. Here is what you have to do:

And that’s it! It’s really easy, and you should be able to get around it without any trouble.

Here are the different details that you will get in the results of our BIN check tool once you enter the BIN code.

Here are some of the features that you can enjoy when using our BIN checker:

Our BIN check tool does not require any sort of registration or signing up. You can use it for free as many times as you want. A lot of online tools have usage limits or signup requirements. However, that problem does not exist with ours.

After you get all the data for the BIN code, you can save it to your device. Click on the “Download Records” button and then select the format to save the information to your local storage.

Although the name of our tool is a BIN checker, it does more than just validate the BIN code. It provides a lot of different details related to the credit card as well, such as the bank it belongs to and the country it is based in.

To better understand the utility of our BIN Lookup, it is important to learn more about the BIN code and what it is.

The BIN code includes the first 6 to 8 digits of a typical credit card number. It stands for “Bank Identification Number.” BIN codes are unique to specific banks and their different branches.

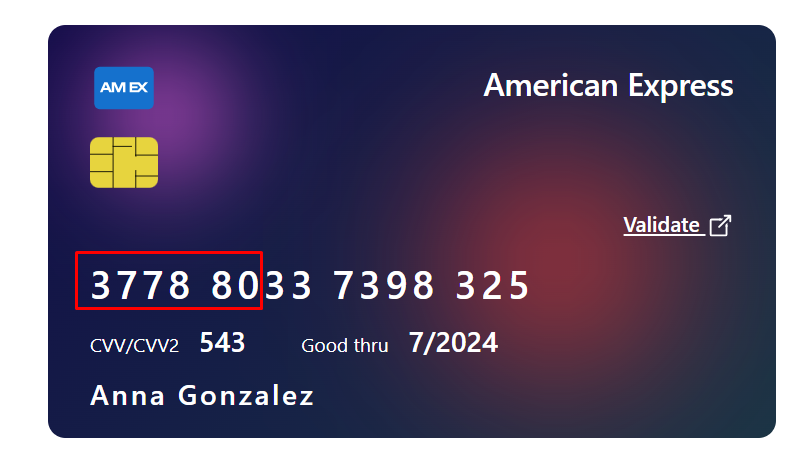

Here is an example of a credit card number and its respective BIN code:

This particular BIN code belongs to The City Bank, Ltd. in Bangladesh.

BIN codes are unique identifiers of credit card numbers.

Our BIN check tool is able to find the details of the entered BIN codes by utilizing a vast database that contains them all. The tool has access to a database that contains all the different BIN codes being used worldwide along with their details, such as the country they are based in and the bank they are issued from.

There are different types of situations that require the use of our BIN checker. For example, you may need to use it for the following:

If there is any reason for you to suspect that the card details being offered by a certain customer are fraudulent, you can use our BIN check tool to allay your concerns. Just enter the BIN code into our tool to see if the card is valid or not. You will also be able to see the other details of the credit card, such as the region where the card was issued.

Another reason to use our BIN verification tool is to gather valuable information about your customers. You can take the BIN codes of the different credit card numbers submitted by your customers and enter them into our BIN Lookup tool. This will allow you to see which region your customers tend to belong to, what type of cards they use, and so on.

With this information at hand, you will be able to adjust your marketing efforts and your inventory to make them both optimal.

It is possible that due to the design of your card (especially with custom designs), some information may not be printed on it. You may not be able to instantly tell whether a card is VISA or AMEX, etc., or whether it’s a Classic or Gold.

Our tool will help you find all of that information in a jiffy. You can simply enter the BIN code of the card number and get all the data you need.

Usually, most CC numbers are 16 digits long. In these numbers, the first six digits make up the BIN code. On the other hand, some CC numbers are 20 digits long, while others can be 18 digits long. In cases like these, the BIN can be the first eight digits instead of six.

You can first try entering the first six digits of the CC number. If you get the results, that’s good. If there is an error instead, you can enter the eight digits instead.

That way, you will get to check both possibilities.

Make sure that you’re adding the BIN code accurately. If a digit is mis-input, the results could come with an error instead of showing the details.

If the details being shown for the entered BIN code are not accurate, make sure that the digits are all added correctly. If the digits are correct, a temporary issue could be causing the incorrect details to show. Try again after some time to get the correct details.

Generally, it doesn’t change and remains consistent for a bank or institution. However, there can be instances where BINs change due to acquisitions, rebranding, or other organizational changes.

No. The BIN cannot be used to identify a cardholder's personal information directly. It only details the issuing institution, card type, country, etc.